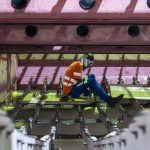

Miners in Zimbabwe are calling on the government to postpone a proposed export tax on lithium concentrate until local processing plants are operational.

The Zimbabwe Lithium Exporters (ZLE), an industry group representing companies including Chengxin Lithium Group, has formally requested a two-and-a-half-year deferral of the 5% export levy. The tax is intended to encourage domestic refining of lithium into higher-value products, but the ZLE argues it should be delayed until 2027, when facilities capable of producing lithium sulfate are expected to be completed and commissioned.

Zimbabwe has rapidly become a key supplier of lithium concentrate to Chinese refineries, following substantial investments by firms such as Chengxin, Zhejiang Huayou Cobalt, and Sinomine Resource Group. According to CRU Group, the country accounted for around 14% of China’s lithium imports last year.

The government currently classifies lithium concentrate as an unprocessed or “unbeneficiated” product, and plans to impose the tax on such exports. However, the ZLE maintains that the tax would hinder growth and should be held off until value-added production begins locally. The refined lithium sulfate is expected to be exported to China for further processing into battery-grade material.

In addition, the industry body raised concerns about how royalty payments are being calculated. According to the ZLE, royalties are being based on the price of lithium carbonate — a more refined and valuable product — rather than the concentrate actually produced in Zimbabwe.

The Chamber of Mines, which represents the broader mining industry, met with the Finance Ministry on May 19 to review the proposals. A spokesperson confirmed the meeting but declined to comment on the ongoing discussions. Officials from the mines and finance ministries have not yet responded to inquiries on the matter.