With NRG Bloom repurposing flared gas to power Bitcoin mining in Nigeria, Gus Anyim, commercial development at the organisation, explains how Bitcoin offers new opportunities for African countries

As the end of the current iteration of 210,000 blocks passed, we reached a milestone for the biggest cryptocurrency in the world – Bitcoin. Written within Bitcoin’s code is a trigger to halve the reward for mining new Bitcoin.

Opinion remains divided as to whether Bitcoin’s “halving” will trigger a renewed push beyond its current US$1.4 trillion market cap. While some analysts point to an asset scarcity from fewer Bitcoin being released. Others think it will be business as usual.

As the debate continues, the companies and individuals supporting the Bitcoin network are not waiting. They have been adapting to both the halving and the wider concerns around the industry with Africa gaining increased prominence in the conversation.

So whether a fresh boom for the popular cryptocurrency lies ahead or a continuation of the status quo. Africa can seek to position itself to benefit from the new realities surrounding Bitcoin.

Clean energy

Every 10 minutes the Bitcoin network updates the blockchain with a new batch of transactions, known as a block. This verification work is done over a globally distributed computer network by bitcoin miners. To incentivise participation, miners receive new Bitcoin and a transaction fee, as payment for each successfully generated block.

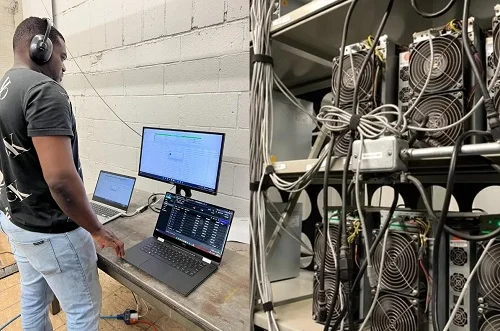

Miners compete with each other, using specialised computers, to add new transactions on the blockchain. The effort is computationally intensive and backlash has followed mainly around the electricity consumption and environmental impact.

International Bitcoin mining firms and smaller scale suppliers have responded by seeking power from clean energy sources. Africa and its abundance of solar, hydro and wind resources has proven an attractive destination.

Africa has an underdeveloped electrical infrastructure. Across sub-Saharan Africa, 600 million people still lack access to reliable electricity. The land mass makes scaling supply difficult enough. As many African countries are also signatories to the Paris Agreement on climate change, further tough choices arise on how to invest in capacity and develop clean energy.

From reusing flared gas (a methane heavy pollutant from the oil and gas industry) for energy to buying unused electricity capacity. Africa can use Bitcoin mining installation to subsidize further network investment, passively generating income from unused electricity supply.

New revenue

Rather than rely solely on supporting the Bitcoin network, miners have often sought to diversify and develop complementary services.

With heavy computing power at work, Bitcoin mining has often supported improvements to electricity infrastructure in emerging economies. Africa can use its excess capacity to support the global technology industry. Giants like Amazon and IBM already have a presence in Africa but with continued investment, Africa can increasingly support industries such as cloud computing and AI.

Semaphore reports that Nigeria, Egypt, Kenya and South Africa have received 76% of the US$15.2bn startup investment in data centres. Mordor Intelligence estimates Africa’s data centre market value at US$740mn, rising to US$1.7bn by 2029.

Bitcoin represents a catalyst to both reframe the industries associated with Africa and spur technology driven growth. With inexpensive access to electricity and an abundance of available land, new facilities could create employment opportunities, accelerating data centre market growth to power Africa and the world.

El Salvador (2021) and the Central African Republic (2022) became pioneers by adopting Bitcoin as legal tender. Over time, more countries may follow. The adoption represents a shift in the perception of Bitcoin and the potential of cryptocurrencies. After institutions, including Blackrock and Invesco, introduced Bitcoin exchange traded products, holding Bitcoin is now seen as a mainstream investment asset.

More citizens across Africa will be inclined to look at this alongside cryptocurrency payment solutions, especially if faced with a declining purchasing power of their fiat currency. Governments too can find solutions to their challenges.

Earlier this year, online publication Cointelegraph covered the Bitcoin buying strategy of El Salvador that had netted the national Treasury an additional US$85mn. The country has also welcomed Bitcoin driven tourism, public-private mining partners, educational programmes and skills training. It is apparent that with clear policy and planning, new opportunities could emerge for African countries.