Caledonia Mining is moving ahead with the development of the Bilboes gold project in Zimbabwe after completing and publishing its feasibility study, which confirmed that a single-phase development is the most economically viable approach.

The project covers 2,731.6 hectares in Matabeleland North, around 80km north of Bulawayo. The study outlines proven and probable reserves of 1.75 million ounces of gold at 2.26g/t, with additional measured and indicated resources of 532,000oz at 1.37g/t, and inferred resources of 984,000oz at 1.62g/t.

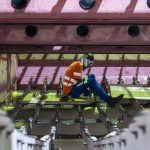

Bilboes will use Metso’s BIOX technology to process refractory ore, enhancing gold recovery by breaking down sulphide minerals ahead of cyanidation. The plant is designed for a throughput of 240,000 tonnes per month for the first six years, later reducing to 180,000 tonnes. Expected metallurgical recoveries range from 83.6% to 88.9%.

Caledonia is targeting around 200,000oz of production in the first full year (2029). Over a 10.8-year mine life, total output is forecast at 1.55Moz, with an all-in sustaining cost of $1,061/oz.

Peak project funding is estimated at $484m, with an additional $100m required for interest and working capital, plus $50m for lender-mandated cost overrun facilities. The company intends to phase its fundraising to maintain liquidity and limit equity dilution.

Caledonia acquired full ownership of Bilboes in January 2023 for $65m, paid via 5.1 million Caledonia shares and a 1% net smelter return to a previous owner.