Many of us couldn’t say where the metals used to make our mobile phones came from, let alone our packaging. But when their consumption could be funding conflict overseas, how do we ensure we responsibly source our minerals? In this edition of The Brief, we uncover the realities of mining ‘conflict minerals’, the rules in place to prevent exploitation, and how packaging companies have responded.

War-torn or politically unstable countries with an abundance of natural resources face high demand for tin, tantalum, tungsten, and gold. These metals are predominantly utilized in jewellery, mobile devices, and the automotive industry, but they also have their uses in packaging.

Tantalum capacitors and resistors are becoming increasingly relevant in the realm of 3D packaging. Tungsten alloys appear in integrated circuit packaging and containers for radioactive materials; tungsten oxide, in particular, can be used in coatings for degradable plastics. Tin is a common ingredient in solder; gold appears in foils and inks for premium packaging; and, of course, the components used in packaging machinery can easily contain such metals.

These materials are collectively referred to as 3TG – or ‘conflict minerals’, since they are sometimes mined through forced labour and, at various points in the supply chain, can contribute to armed conflict, corruption, and money laundering.

In the Democratic Republic of the Congo (DRC), for instance, traders have been known to finance armed groups amidst national turbulence (e.g., ongoing conflicts in North and South Kivu). In 2009, the International Peace Information Service recorded the presence of armed groups at over 50% of sites in the Kivu provinces; and the problem persists into 2024, with international lawyers recently telling Reuters that the country is seeking clarification regarding the illegal exportation of conflict minerals within Apple’s supply chain.

It is often unclear to consumers, and even to manufacturers, whether the products they purchase are funding criminal activities or human rights violations. As Julia L Freer Goldstein highlights in Materials & Sustainability: Building A Circular Future, the connection is not an inherent one. Not every mine exploits children or enslaved workers; and the complexity of the global supply chain means that, from ores to packaging components, 3TG materials change hands many times.

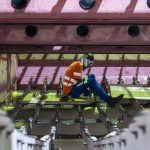

However, in the modern age, a mineral’s origins are not obscure by default. It is a lack of transparency across the supply chain that keeps customers and consumers in the dark, and thus the exploitation continues. Miners have previously reported spending between twelve and forty-eight hours underground in hazardous conditions; many are children, with Amnesty International’s investigation into cobalt extraction recording accounts of payment as low as 1,000 Congolese Francs (€0.33), beatings at the hands of security guards, and subsequent wage theft.

Another interviewee claimed that accidents often go unreported when mines operate without licenses in unauthorized areas. As of the paper’s publication, there was no official data on the number of fatalities. An article published in The New York Times also revealed a lack of sufficient on-site medical care, with under-trained doctors charging for emergency treatment to make ends meet.

Steps are being taken to make these forms of exploitation unprofitable and counteract blind spots. Industrial organizations have developed methods of identifying conflict minerals within companies’ supply chains; in turn, these are being introduced into (inter)national regulations around the mining, sourcing, and use of conflict minerals.

Rules and regulations

At the very beginning of the supply chain, the Global Industry Standard on Tailings Management enforces rules surrounding the by-products of mining. Among other expectations, operators must manage any social and environmental risks associated with their operations through a ‘methodological approach’.

Furthermore, in line with the United Nations Guiding Principles on Business and Human Rights (UNGPs), they must respect the self-determination of indigenous and tribal peoples whom the mining process may affect. This involves the affected communities being informed of their rights and making their own decisions without pressure, coercion, or any undue influence from the operators.

For our purposes, the most relevant requirement involves companies participating in global transparency initiatives. By creating standardized, independent, industry-wide, and publicly accessible databases and inventories, these initiatives keep companies up-to-date about the integrity and safety of tailings facilities.

As we have seen, though, these rules continue to be violated, and global legislation is becoming increasingly concerned with keeping 3TG out of companies’ supply chains.

Signed into law in June 2017 and enforced from January 2021, the EU Conflict Minerals Regulation intends to prevent the illegal exploitation of minerals, and the resultant abuse of local communities, in times of social or political unrest. It seeks to ensure that smelters and refiners in the EU and beyond source their 3TG minerals responsibly; and holds EU importers to international responsible sourcing standards set by the Organisation for Economic Co-Operation and Development (OECD).

Importers of minerals are expected to declare which countries their supply comes from, when it was mined, and the quantity imported. Mineral and metal importers alike must list their imports by trade name and type, and provide the names and addresses of their suppliers. Supporting documents must be provided as evidence, and the entire process should form part of the importer’s internal management system.

In the event that minerals are sourced from high-risk areas affected by conflict, extra information must be provided about the minerals’ provenance; where they were consolidated, traded, and processed; and the taxes, fees, and royalties paid to acquire them.

In the United States, the Dodd-Frank Wall Street Reform and Consumer Protection Act – a federal law enacted in 2010 and updated several times since – mandates full disclosure if any conflict minerals “necessary to the functionality or production of a product” come from the DRC or surrounding regions.

If a company reports to the Securities and Exchange Commission under the Securities Exchange Act, it is required to collect data about its suppliers using the Conflict Minerals Reporting Template (CMRT). Created by the Responsible Minerals Initiative (RMI), this standardized template records a mineral’s country of origin, as well as the smelters and refiners being utilized, and identifies new smelters and refiners to be assessed through the RMI’s Responsible Minerals Assurance Process.

Companies must also conduct a Reasonable Country of Origin Inquiry (RCOI). In doing so, they are expected to disclose whether their conflict minerals were sourced in the DRC, Zambia, Angola, Republic of the Congo, Central African Republic, South Sudan, Uganda, Rwanda, Burundi, or Tanzania, and whether the minerals fund or otherwise benefit armed groups.

In any scenario, a Conflict Minerals Report must be conducted and displayed on the company’s website. Within it, a company must gauge whether their product falls under the categories of DRC Conflict Free, Not Found to Be DRC Conflict Free, and DRC Conflict Undeterminable. Each comes with its own reporting requirements.

If a mineral did originate from one of the listed countries, or if it is a possibility – and if it is not sourced from scrap or recycled materials – a framework such as the OECD Due Diligence Guidance must be used to examine the mineral’s source and chain of custody. These processes are designed to identify human rights violations or bribery within a company’s supply chain, among other impacts.

Meanwhile, the Chinese Due Diligence Guidelines for Responsible Mineral Supply Chains, launched in late 2015, refers to the UNGPs and OECD Due Diligence Guidance. It lays out a five-step model to ‘prevent and mitigate’ human rights abuses, and applies to all Chinese companies extracting, trading, processing, transporting, and/or using 3TG minerals.

Companies are expected to establish risk management systems and clearly communicate their policies to suppliers and consumers alike. Contracts and agreements with suppliers should contain a supply chain policy in line with the Chinese Responsible Mining guidelines, and as an early-warning risk-awareness system, a company-level or industry-wide grievance mechanism should be put in place.

Upstream companies must set up a chain of custody or traceability system to pass due diligence information downstream. They are expected to engage with their suppliers to identify and confirm a materials’ source, as well as any potential risks or warning signs. Individual or collaborative ground assessments should collect information about a mineral’s production, handling, and trade, while recycled resources should utilize risk-based assessments to check whether they have been laundered to obscure their origin.

Downstream companies should identify products containing 3TG minerals and, to the best of their ability, identify the key upstream actors in their supply chain. An independent third-party audit should be conducted to collect data on key upstream actors, as well as the countries and regions they source from. Any available audit information, policies, and public reports should undergo due diligence.

Where risks are identified, companies are expected to report their findings to the company’s designated senior management. From here, a risk management strategy could either continue or temporarily pause trade while conducting measurable risk mitigation efforts. Suppliers and affected stakeholders – including local and central government authorities, international and civil society organizations, and third parties – should be consulted, and all should agree on the chosen strategy.

If mitigation fails or falls short, companies are encouraged to consider cutting ties with a supplier. Before making a choice, they should weigh up whether disengaging would threaten livelihoods or economic activity for communities in or around the mineral extraction sites.

In any case, the risk mitigation efforts are to be monitored, tracked, and reported back to senior management. Companies are expected to publicly report on their due diligence policies and practices, which includes any risks identified and steps taken to mitigate them. Due diligence practices are to be audited by independent third parties, which may be verified by an independent institutionalized mechanism such as an established industry programme.

While the list of national and international rules continues, the same themes recur – thorough investigation, meaningful courses of action, and publicly accessible information on the procedures undertaken. With that in mind, let’s take a look at the ways companies have put these expectations into practice.

Due diligence in practice

It is worth noting that companies outside the packaging industry have often excluded their packaging suppliers from due diligence and risk assessment processes; this is attributed to a low likelihood of 3TG being present in their operations in the first place. However, we can use a range of industry players working directly with metals as examples of 3TG-related legislation in action.

In October 2023, Trivium Packaging released a conflict minerals report. It explained that, since the company’s steel packaging contains tinplate, it had conducted an RCOI and requested that all suppliers using tin in their processes complete a CMRT. All new tinplate suppliers were also asked to provide a CMRT and a declaration as part of Trivium’s supplier evaluation process and selection criteria.

As of 2022, none of the suppliers were thought to utilize conflict minerals sourced from the DRC or adjoining countries. The company stated its intent to work with suppliers to raise awareness around conflict minerals going forward, as well as to join the RMI.

Apparently, Trivium’s due diligence programme was designed in line with the EU Conflict Minerals Regulation – and, even though Trivium is not listed on the US Stock Exchange and is not held to this particular set of rules, the Dodd-Frank Wall Street Reform and Consumer Protection Act.

In a similar process, Ardagh Metal Packaging identified the “small percentage” of its steel beverage cans as made of electrolytic coated tinplate. It conducted an RCOI, in which its tinplate suppliers completed RMI’s Conflict Minerals Reporting Template and Ardagh evaluated smelters in line with its Conflict Minerals Reporting and Review procedures. From this, it concluded that, in 2023, none of its tinplate constituted a conflict mineral, nor was it sourced from a location at risk of funding conflict.

Another report from Graphic Packaging was less definitive. Some of the components used in its packaging machinery possibly utilized conflict minerals, and since an RCOI was unable to confidently locate the place of origin for every mineral it used, the company undertook due diligence.

Bringing together its legal, controllership, environmental, internal audit, and supply chain organizations, the company claims to have adhered to the OECD Due Diligence framework by requesting that all its suppliers from 2023 complete the Electronic Industry Citizenship Coalition (now the Responsible Business Alliance) and Global e-Sustainability Initiative’s Conflict Minerals Reporting Template. 87 of the 134 responding suppliers stated that their products did not contain 3TG.

Although 47 suppliers reported that their products contained conflict minerals, 27 did not source their 3TG from the DRC or its neighbouring countries. Furthermore, of the 35 whose products contained 3TG from countries of concern, 27 assured Graphic Packaging they had bought the products from conflict-free vendors. Four could not say for certain that their minerals were conflict-free.

Therefore, Graphic Packaging could not say with confidence that the materials, parts, and components it had sourced in 2023 were not funding conflict or exploitation. It went on to lay out its risk mitigation and due diligence improvement programme, in which it would work with legacy and newly acquired businesses to gather complete and accurate information around its sourcing of 3TG.

Once again, it would request information from its suppliers using the same Conflict Minerals Reporting Template; and it would mandate that new and renewed contracts with suppliers provide information about the existence and sourcing of 3TG in their products.