Kholo Capital Mezzanine Debt Fund I (“Kholo Capital”) (www.KholoCapital.com) and Maia Capital Partners (“Maia Capital”) announced today that they have provided R250 million mezzanine debt funding to Catapult Group (“Catapult”) to fund growth capital expenditure and to refinance a portion of existing senior debt to create cashflow headroom for the business as it embarks on its next growth phase. Catapult is a leading South African manufacturer and distributor of specialized building products, with a strong presence in the commercial, industrial, and residential real estate sectors with a 3,000-store retail distribution footprint.

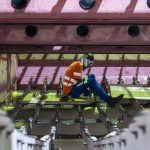

Catapult expanded in the past few years through strategic acquisitions, including the acquisition of Everite and Swartland businesses. Everite is known for its comprehensive range of Nutec products. The Nutec brand is Everite’s proprietary fibre cement product line, encompassing ceilings, cladding, roofing (i.e., fascia boards, barge boards and roofing slates), facades, windowsills, cornices, building columns and lightweight Autoclaved Aerated Concrete (“AAC”) bricks. Swartland is a market leading manufacturer of quality wood window frames, doors, garage doors, skirtings, finishes, par awnings, XPS insulation, cornices and lightweight aluminium-alloy window frames and doors.

Zaheer Cassim, Managing Partner and Founder at Kholo Capital, remarked: “We are delighted to be part of this growth and refinancing transaction with the Catapult Group. Our R250 million investment will assist the Catapult Group with its growth objectives and provide additional financial flexibility which positions the company for sustained growth and further value creation. This growth will in turn create new jobs over the investment period, which is a key focus of the Kholo Capital investment mandate.”

Mokgome Mogoba, Managing Partner and Founder at Kholo Capital, observed: “Catapult is supported by a strong management team and established equity sponsors with solid net asset bases and extensive industry expertise. The business has consistently delivered strong earnings performance, supported by long-established brands, highly recognizable building products, and a dominant market share in its key segments. We look forward to providing strategic input, adding value and propelling the Catapult Group to achieve its growth objectives.”

Tshandu Ramusetheli, CEO of Maia Capital, said: “This significant investment highlights Maia Capital’s commitment to fostering sustainable development, particularly in one of our key impact themes of access to affordable, quality housing. By supporting Catapult, we are taking meaningful steps to ensure that all individuals have access to essential housing and services. This partnership exemplifies our belief that impactful investments can drive both economic growth and social progress.”

Robin Vela, Chairman of Catapult Group, commented: “The support from Kholo Capital and Maia Capital will enhance our ability to deliver long-term value to our customers, employees, and shareholders. Importantly, the investment will also facilitate job creation and contribute positively to the broader South African economy, an outcome we are deeply committed to. We extend our gratitude to Kholo Capital, Maia Capital, our equity partners and our management team for their unwavering belief in Catapult’s potential. Together, we are well positioned to achieve our strategic objectives and unlock sustainable growth.”

Norton Rose Fulbright acted as legal counsel to Kholo Capital and Maia Capital

Distributed by APO Group on behalf of Kholo Capital. For more information contact:

Zaheer Cassim