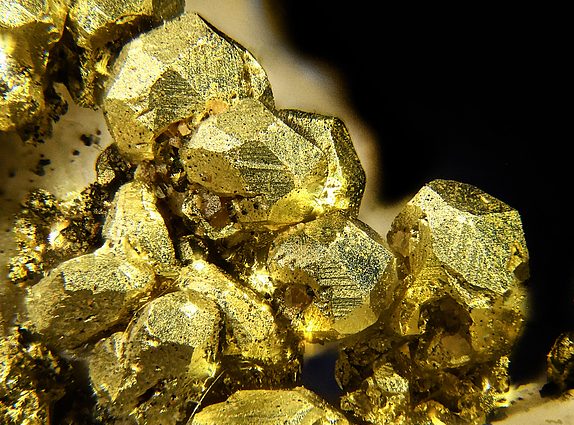

Leviathan Gold has entered into a non-binding letter of intent (LoI) with Cura Exploration Botswana to acquire 100% of Privco, a company holding a significant portfolio of copper and uranium exploration licences in Botswana.

Through this acquisition, Leviathan will gain access to the Central Project, located adjacent to MMG’s $1.9 billion Khoemacau copper deposits, and a collection of uranium prospecting licences, including the Serule Uranium Project. Recent drilling at Serule has revealed a mineralised zone over 4km wide, positioned near Lotus Resources’ Letlhakane Uranium Project.

Privco is currently party to share purchase agreements (SPAs) to acquire the AfriMetals Entities, which own the aforementioned assets. The Central Project is considered strategically significant due to its proximity to known mineralisation and shared geological features with Khoemacau.

Under the proposed terms, Leviathan will issue 35 million common shares and 5.5 million share purchase warrants in exchange for Privco’s shares and warrants. The company may also issue up to an additional 16.5 million shares as milestone payments.

If the deal proceeds, former Privco shareholders would hold approximately 35% of Leviathan Gold, increasing to 38.5% if all warrants are exercised. The transaction is expected to be completed through a “three-cornered” amalgamation involving a wholly owned Leviathan subsidiary and is subject to regulatory approval by the TSX Venture Exchange.

Leviathan Gold President and CEO Luke Norman commented:

“The proposed acquisition of Privco positions Leviathan at the forefront of copper exploration in Botswana, placing us alongside MMG’s world-class Khoemacau Cluster. The Central Project shares key geological indicators and offers enormous discovery potential in a highly prospective region.”

Privco is obligated to fulfil financial terms under its SPAs, including a total cash payment of $2.2 million, of which $390,000 has already been paid. Additionally, it has invested C$93,000 in NI 43-101-compliant technical reports on the properties.

The transaction remains subject to a 60-day due diligence period and finalisation of a definitive agreement.