NextSource Materials (TSX: NEXT) announced on Thursday that it has signed a mandate letter with the International Finance Corporation (IFC), the private sector investment arm of the World Bank Group, to lead a senior debt facility amounting to $91 million.

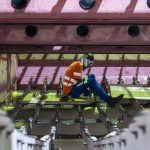

The company plans to allocate approximately half of these funds to expand its Molo graphite mine in southern Madagascar. The mine, which commenced production a year ago, currently produces NextSource’s trademarked SuperFlake graphite concentrate at a capacity of 17,000 tonnes per annum (tpa). The planned expansion aims to nearly increase this capacity ninefold to 150,000 tpa.

A December 2023 feasibility study estimated that the expansion would require a capital investment of $161.7 million (including contingency), plus $25.2 million in working capital. This expansion is projected to yield a post-tax net present value (NPV) of $370 million, using an 8% discount rate, and an internal rate of return (IRR) of 29%.

IFC’s commitment to provide the financing is contingent upon the completion of technical, social, legal, and environmental due diligence, which has already begun and is expected to be completed by Q1 2025.

With IFC’s backing, NextSource CEO Craig Scherba stated that the company is “poised to unlock Molo’s vast potential and further contribute to long-term sustainable development in Madagascar.”

The Molo project boasts one of the world’s largest graphite deposits, with a measured resource of 23.6 million tonnes grading 6.32% carbon and an indicated resource of 76.8 million tonnes grading 6.25%.

NextSource Materials aims to leverage this resource to become a vertically integrated global supplier of EV battery materials. This strategy includes constructing battery anode facilities capable of producing large-scale coated, spheronized, and purified graphite. The first such plant is planned for Mauritius, where the company has already submitted an application and signed a lease agreement for the site.

Following the announcement of the IFC partnership, NextSource Materials’ shares rose 10.3% to C$0.86, bringing the company’s market capitalization to C$134 million ($94.5 million).